DEAL BRIEF

India’s Finance Minister, Shri Arun Jaitley, announced the setting up of a National Investment and Infrastructure Fund (“NIIF” or “Fund”) in the Union Finance Budget 2015-16 on February 28, 2015. With the proposed corpus of INR 40,000 Crores (USD 6.04 Billion), the Finance Minister has indicated that an annual flow of INR 20,000 Crores (USD 3.02 Billion) would be ensured for the NIIF to enable it to raise capital, and in turn, invest primarily in the infrastructure sector.

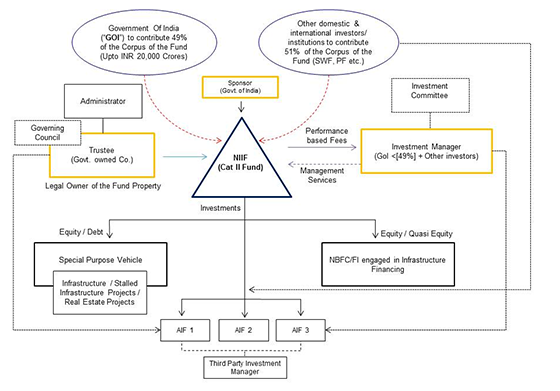

NIIF has been set up as a fund of funds structure and is registered with Securities and Exchange Board of India (“SEBI”) as a Category II Alternate Investment Fund (“AIF”) under the SEBI (Alternative Investments Funds) Regulations, 2012 (“AIF Regulations”). Government’s contribution to the Fund shall be 49% of the total commitment at any given point of time and shall neither be increased beyond nor allowed to fall below the threshold of 49%. The whole of 49% would be contributed by the Government of India as contributions to the Fund. National Investment and Infrastructure Fund Trustee Ltd. (“NIIF Trustee Ltd.”) is a Govt. company and National Investment and Infrastructure Fund Ltd. (“NIIF Ltd.”) is expected to have 51% as private shareholding in the future.

The aim of the Fund is to pool commitments from Sovereign Wealth Funds, long term funds based outside India and government supported institutions within and outside India as permitted under the AIF Regulations to subsequently utilize the same in making investments into the infrastructure sector. These investments shall include both, greenfield and brownfield projects. The platform could also consider investments into other commercially viable projects within the broader investment strategy of the Fund. It could also consider other nationally important projects for example, in manufacturing, if commercially viable.

There is a Governing Council, chaired by the Finance Minister, that acts as an advisory council and provides strategic advise in relation to a) Guidelines for Investment of Trust property/Corpus of NIIF; b) Parameters for appointment and performance of investment managers/ advisors; and c) Any other matter related or incidental thereto. The Governing Council consists of other distinguished persons such as Department of Economic Affairs, Secretary, Department Financial Services, Smt. Arundhati Bhattacharya (Chairman, State Bank of India), Shri Hemendra Kothari (Chairman, DSP BlackRock Investment Managers Pvt. Ltd.) and Shri T.V. Mohandas Pai (Chairman, Manipal Global Education Services).

Press coverage relating to the NIIF is available here (Economic Times), here (LiveMint), here (Business Standard) and here (Moneycontrol).

OUR ROLE

We, at Nishith Desai Associates, acted as Legal and Tax Counsel to NIIF and advised the Department of Economic Affairs, Ministry of Finance, Government of India on the legal, tax and regulatory issues in relation to setting up of the NIIF, NIIF Trustee Ltd. and NIIF Ltd., including its negotiations with potential investors of NIIF.