Tax Hotline

December 06, 2008

The Vodafone Judgment: Tax Uncertainty for M&A and PE Deals

One of the most anticipated judgments in recent times, the Order of the Bombay High Court (“Court”) in the Vodafone controversy, is finally out. This judgment raises uncertainties with respect to taxation of cross-border mergers and acquisitions between two foreign entities, involving direct or indirect subsidiaries or affiliates in India. It also brings uncertainty to private equity funds which acquire shares of foreign companies in a similar fashion.

We had published our detailed commentaries on the Vodafone Controversy as it had unfolded in the courtroom and we do not wish to spill more ink recounting the arguments, which are available at the footnote.* The broad facts of the case are briefly summarized as follows:

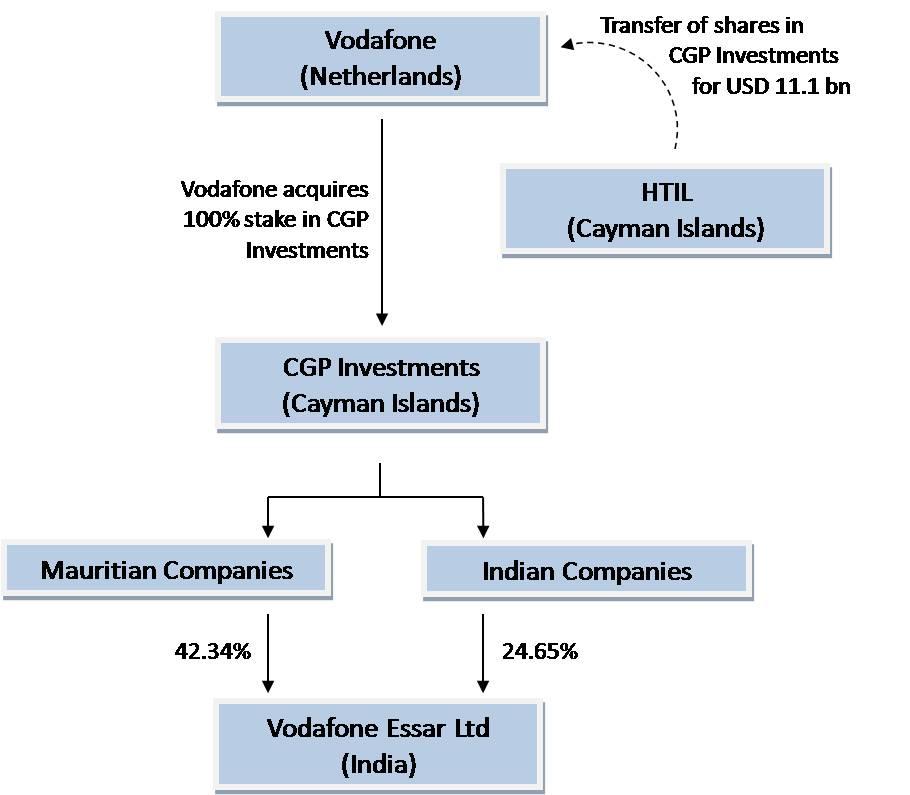

Shares of CGP Investments, a company incorporated in the Cayman Islands were transferred by HTIL, another Cayman Islands company to Vodafone International Holdings BV (“Vodafone”) for a consideration of about USD 11.1 billion. CGP Investments held stake in a series of Mauritian and Indian Companies which cumulatively held about 67% stake in Vodafone Essar Limited (“VEL”). The Indian Revenue Authorities (“Revenue”) issued show cause notices (“Notices”) to both Vodafone and VEL as to why they should not be held as “assesses in default”, the former on the ground of failure to withhold taxes at source and the latter as a “representative assessee”. Both VEL and Vodafone filed respective writ petitions before the Court challenging the validity of these Notices

The Court has dismissed Vodafone’s writ petition on the ground of non-maintainability. As we had reported on December 3, 2008, the Court has dismissed the writ petition and has made five important observations. In today’s commentary, we have analyzed these observations and have also set out our analysis of the judgment. The five observations made by the Court before dismissing the petition are:

-

Vodafone had approached the Foreign Investment Promotion Board (“FIPB”) before effecting the transfer of shares of the Cayman Islands entity. Therefore it was within the jurisdiction of the Revenue to proceed against Vodafone and the Notice served was valid;

-

The transaction amounted to an indirect transfer of controlling interest in VEL, an Indian company and hence an indirect transfer of capital asset situated in India;

-

The transaction created a “real link” between India and Vodafone, so as to bring the consideration to tax in line with the “Effects Doctrine” as understood in USA;

-

The agreement entered into between Vodafone and the vendor was not furnished before the revenue authorities or the Court;

- The writ petition to impugn the Notice was not maintainable when an alternative statutory remedy was available to Vodafone

It must also be pointed out that while the Court made the above observations, it has not held that Vodafone is liable to pay tax or penalties under the ITA.

It is pertinent to note that the Vodafone controversy is not limited to the writ petition filed by Vodafone but also the writ petition filed by VEL. However, the order seems to dismiss the entire controversy solely on the submissions made by Vodafone without hearing the submissions of VEL. With due respect, this seems to be in the teeth of the principles of natural justice which require a party to be heard before any judgment is passed.

While the writ petition has been dismissed by the Court, the issues relating to the Vodafone controversy have not been settled and the Order leaves much to be desired.

- International Tax Team

________________________________

* We had published our daily commentaries on the Vodafone Controversy as it had unfolded in the courtroom. These commentaries can be accessed here: June 27, 2008, June 30, 2008 July 2, 2008, July 8, 2008, July 9, 2008, July 10, 2008, December 3, 2008

Disclaimer

The contents of this hotline should

not be construed as legal opinion. View detailed disclaimer.

This hotline does not constitute a

legal opinion and may contain information generated

using various artificial intelligence (AI) tools or

assistants, including but not limited to our in-house

tool,

NaiDA. We strive to ensure the highest quality and

accuracy of our content and services. Nishith Desai

Associates is committed to the responsible use of AI

tools, maintaining client confidentiality, and adhering

to strict data protection policies to safeguard your

information.

This hotline provides general information

existing at the time of preparation. The Hotline is

intended as a news update and Nishith Desai Associates

neither assumes nor accepts any responsibility for any

loss arising to any person acting or refraining from

acting as a result of any material contained in this

Hotline. It is recommended that professional advice

be taken based on the specific facts and circumstances.

This hotline does not substitute the need to refer to

the original pronouncements.

This is not a spam email. You have

received this email because you have either requested

for it or someone must have suggested your name. Since

India has no anti-spamming law, we refer to the US directive,

which states that a email cannot be considered spam

if it contains the sender's contact information, which

this email does. In case this email doesn't concern

you, please

unsubscribe from mailing list.

|